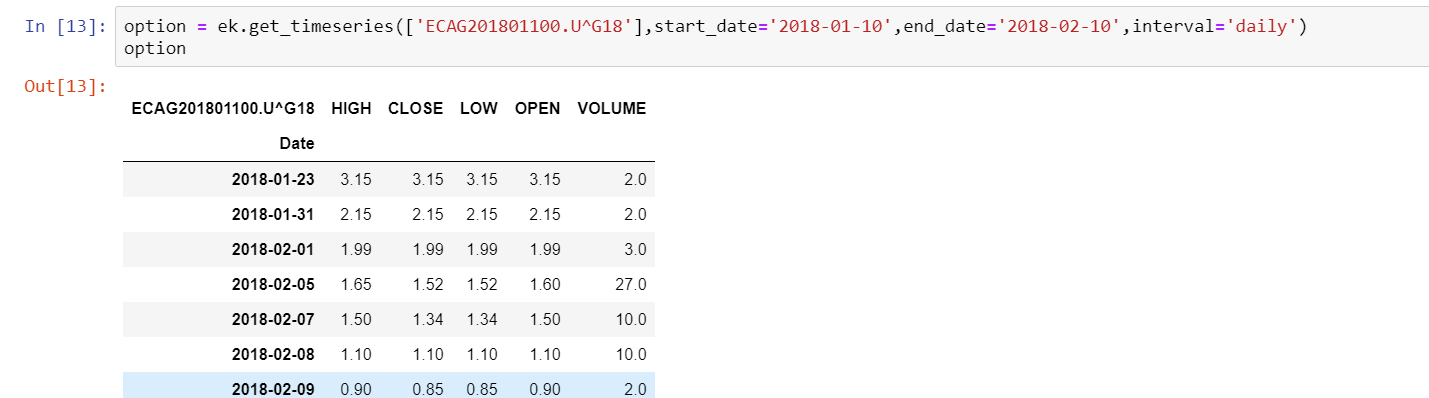

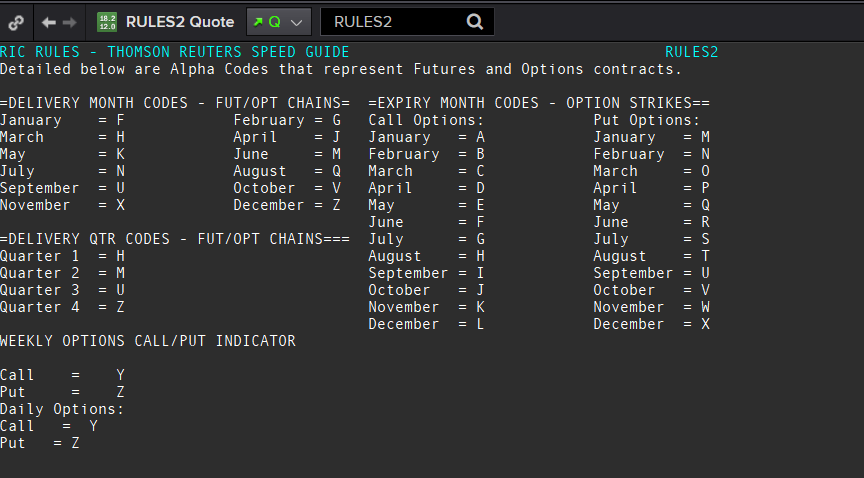

I trying to get the option price (Put and Call) for a given ticker, and the following criteria? I am getting lost in seeing the proper way to do this via Eikon API. Do you have any ideas on how to get it done?

For example, given the following criteria, what is the best way to get the put and call option price?

Ticker

Date - 11/1/18

Strike price - closest to 11/1/18's price (I can inject it during the API call, if need be)

Expiration - Next expiring and atleast 15 days away from 11/1/18

May be I need to do multiple queries to get the appropriate option RICS and then query again for the price. Eitherway is fine. Just looking for a workable solution. Appreciate any guidance