Hi,

I'm trying to pull historical strike prices for constant maturity oprions:

data = ek.get_timeseries('SPX24MO=R',fields = 'STRIKE_PRC',start_date='2019-09-30', end_date='2019-10-22')

which returns:

SPX24MO=R STRIKE_PRC Date 2019-09-30 NaN 2019-10-01 NaN 2019-10-02 NaN 2019-10-03 NaN 2019-10-04 NaN 2019-10-07 NaN 2019-10-08 NaN 2019-10-09 NaN 2019-10-10 NaN 2019-10-11 NaN 2019-10-14 NaN 2019-10-15 NaN 2019-10-16 NaN 2019-10-17 NaN 2019-10-18 NaN 2019-10-21 NaN 2019-10-22 NaN

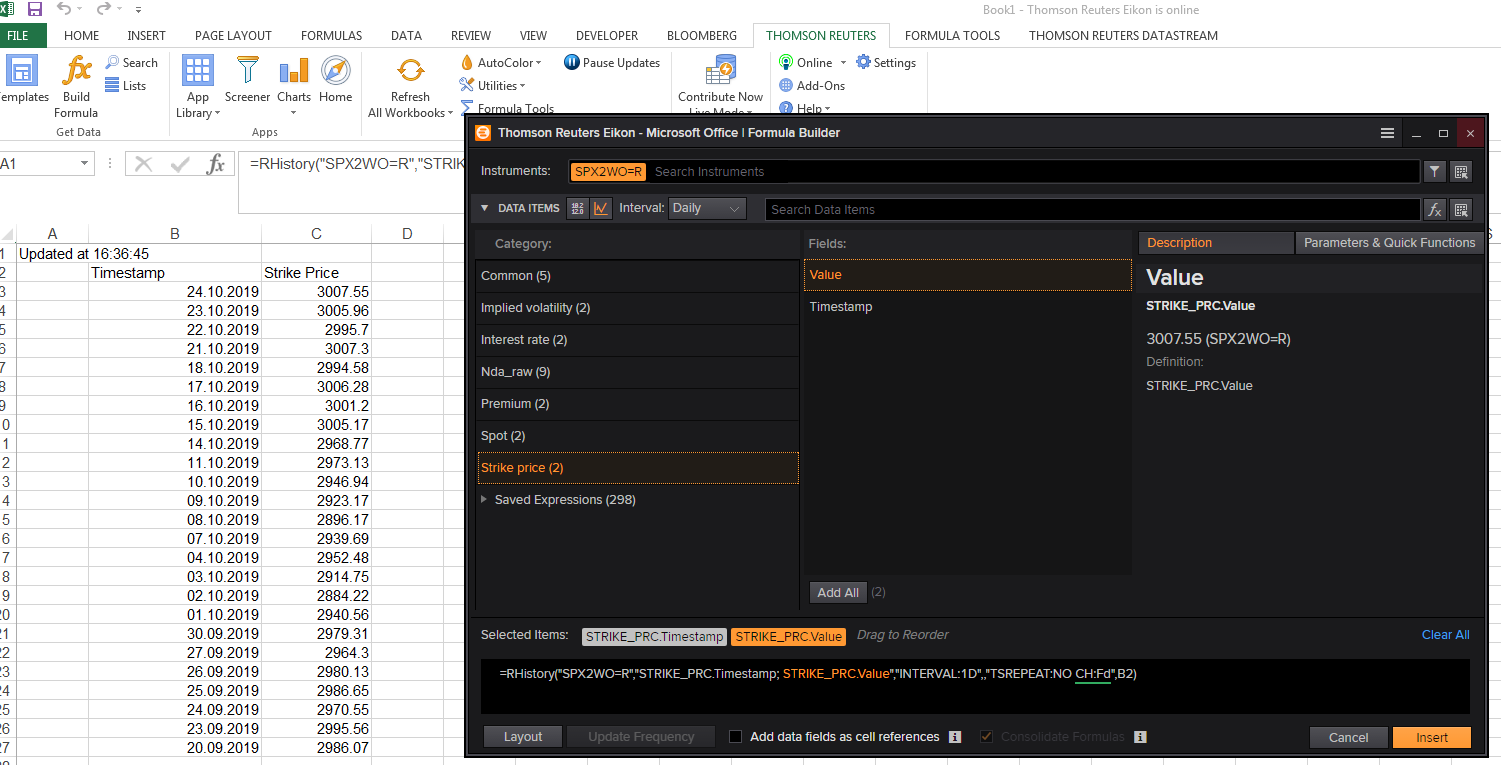

however, using Excel formula builder with following formula "=RHistory("SPX2WO=R","STRIKE_PRC.Timestamp;STRIKE_PRC.Value","INTERVAL:1D",,"TSREPEAT:NO CH:Fd",B2)"

returns the data I'm looking for:

is there a way to pull the historical strikes to python?

Thanks,

Steffen