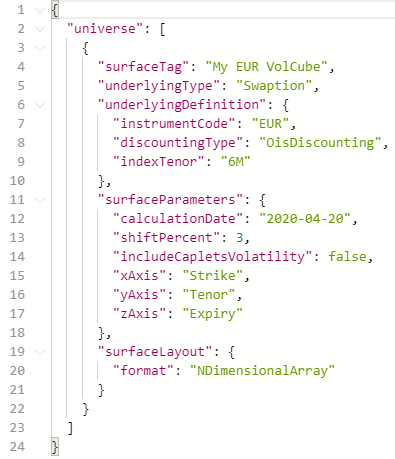

Hi, I am currently trying to understand the response of the example code in here:

Firstly, I would like to know if it is possible and how to retrieve the normal volatilities.

I would also like to understand what is the content of 'calibrationParameters', the data structure is not well defined and there are negative values.

Finally, this volatility data is Bid, Ask or Mid? Is there any way to indicate it in the header?

Thank you.