Hi, I'm in the codebook examples: 03. Quantitative Analytics/03.07. Common and utilities/Option_Pricing, specifically looking at the OTC FX Option example. I am able to run the code as presented, but when I introduce a historical valuation date, I am getting an error. Can you let me know the issue?

Below is the code I am trying to run - only change from the example is adding the pricing_parameters "valuation_date" argument and removing the fields argument.

import refinitiv.data as rd

import refinitiv.data.content.ipa.financial_contracts as rdf

from refinitiv.data.content.ipa.financial_contracts import option

rd.open_session()

response = option.Definition(underlying_type=option.UnderlyingType.FX,

underlying_definition=option.FxUnderlyingDefinition("AUDUSD"),

tenor="5M",

strike=0.6400,

call_put="Call",

exercise_style="EURO",

notional_amount=1000000,

notional_ccy="AUD",

pricing_parameters=option.PricingParameters(valuation_date="2025-10-01")

).get_data()

response.data.df

Error message received:

RDError: Error code QPS-Pricer.4000 | Pricing error : an internal error occurred. An unexpected error occurs during pricing step.

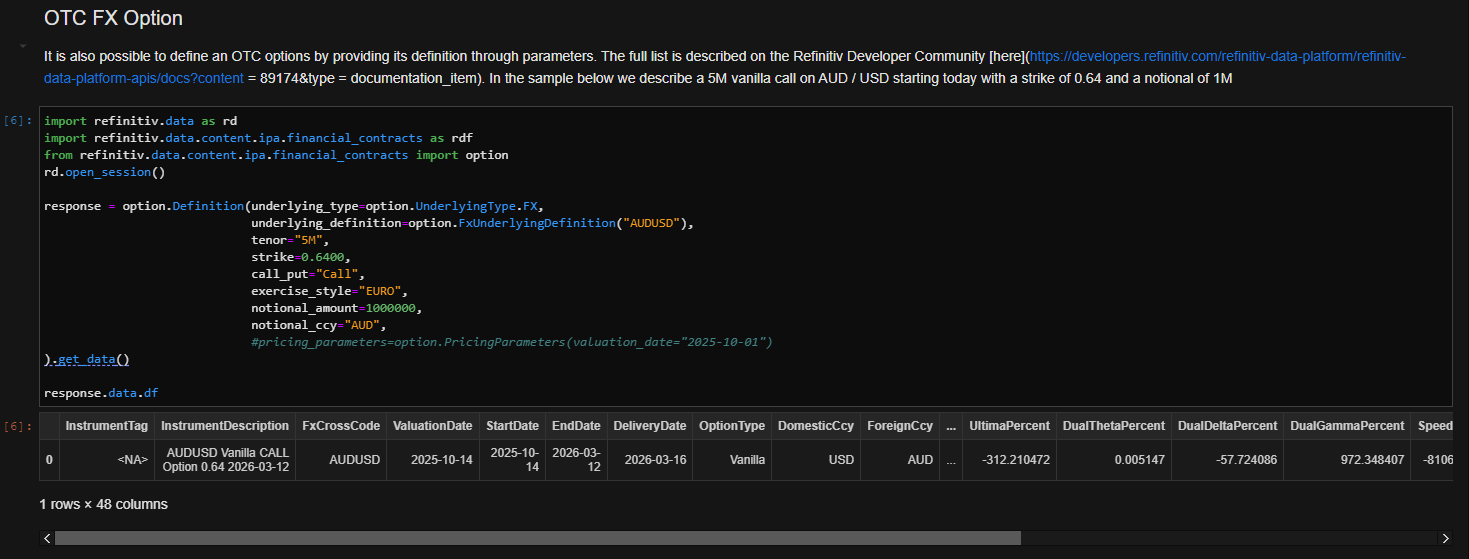

Without the pricing_parameters "valuation_date" argument I get the output expected:

Thanks