I am trying to retrieve historical data from EIKON python data API.

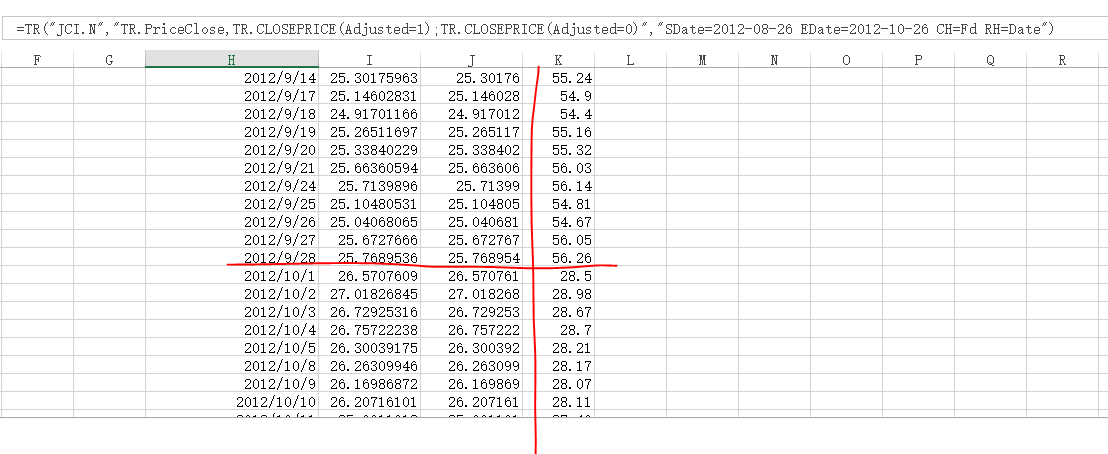

with bellowing code:

ek.get_timeseries('JCI.N', fields='*', interval='daily', start_date="2010-0-04", end_date="2018-10-20", corax='unadjusted')

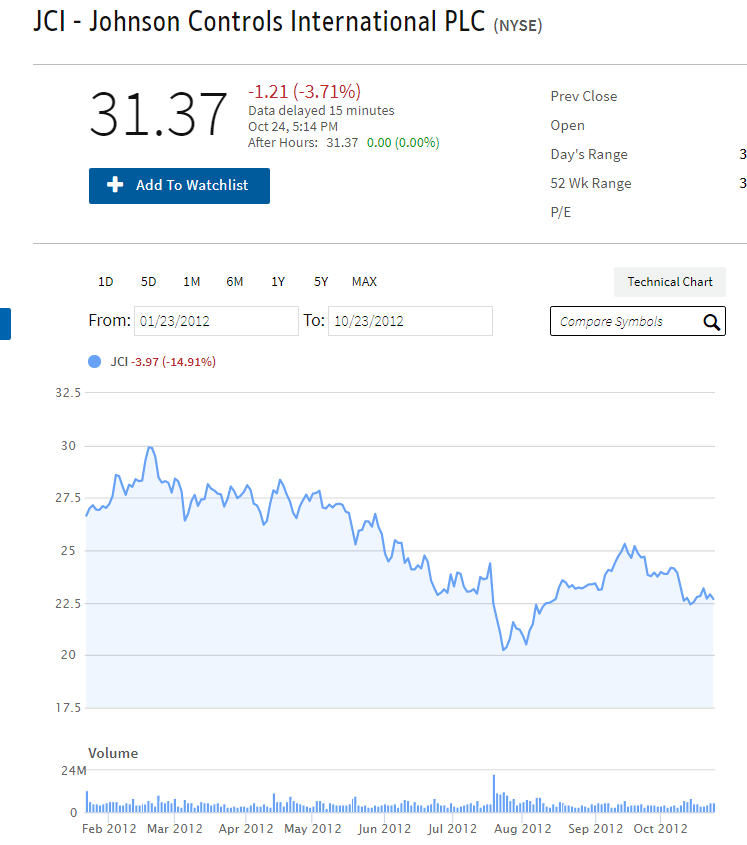

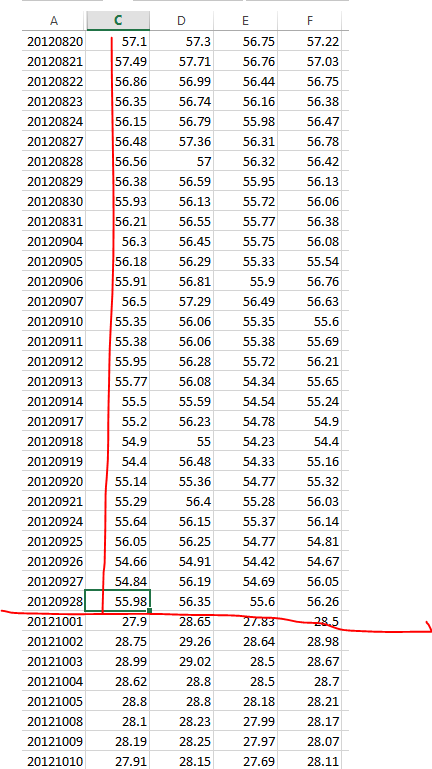

with the comparison of Yahoo Finance and investopedia. it sounds the get_timeseries returned the "Adjusted" price before Oct.1, 2012.

Could someone throw some lights here?

EIKON: all price above $50 before Oct.1, 2012.

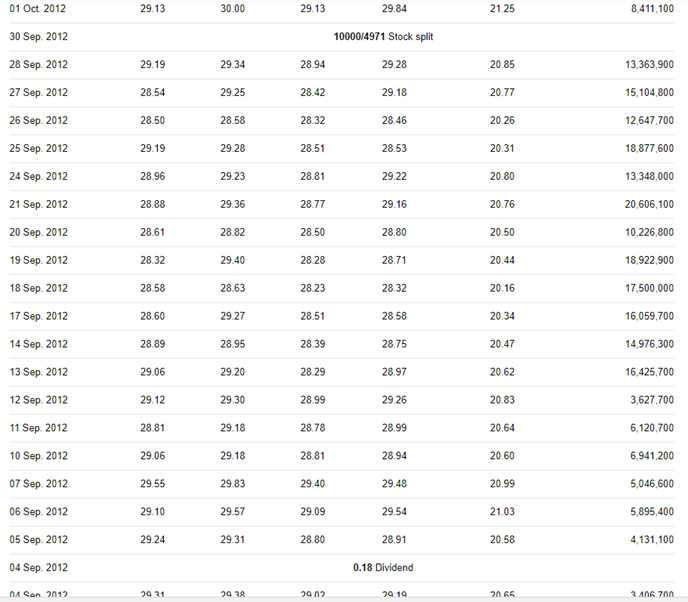

Yahoo finance