Hi,

My objective here is to download a list of instrument data details and save them in our metadata database. For this, I have been advised to use the Terms and Conditions API.

Questions is: is there a good way to identify if the RIC is an equity, a future or an option?

What I see is that there is a field called "Asset Category", and it returns a 3-character code like:

EIF, EIO, EIS ,EQI, FXF, IRF, IRX, ORD

Now, I believe EIO is probably "Equity Index Option" or something, so you may argue that this can be used to check if an instrument is option/equity/future, however

- Is there a better way? (is there another field that can simply return something like EQ/OPT/FUT)

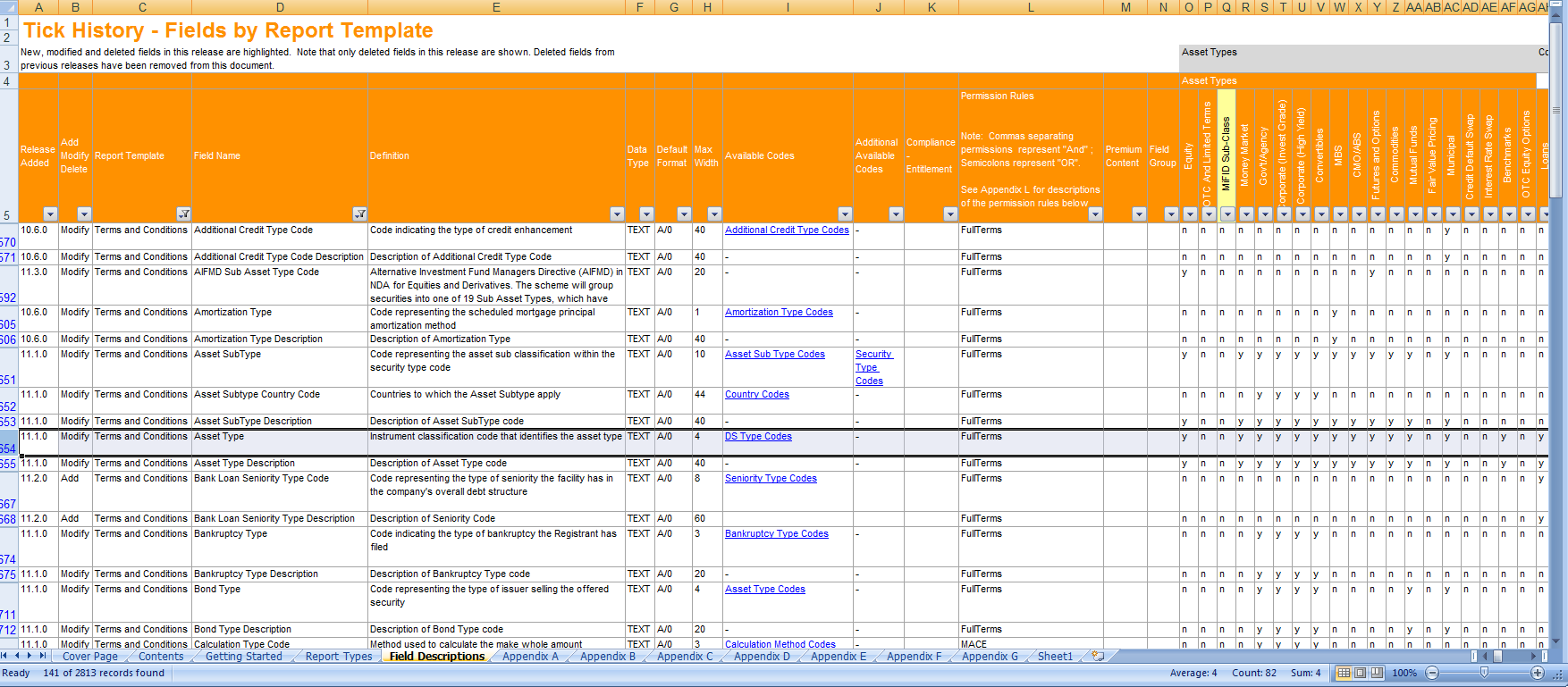

- if Asset Category is the way to go, is there somewhere I can obtain a FULL list of what these "FXF", "EIS" code means?