Historical closing price of stocks using API

I have a dynamic set of stocks (RICs) for which I want to get the closing price data from say last 6 years on daily weekly and monthly level in USD. How Do I do that using LSEG APIs.

Answers

-

Thank you for reaching out to us.

You can use the get_history method in the LSEG Data Library for Python to retrieve historical data.

For example:

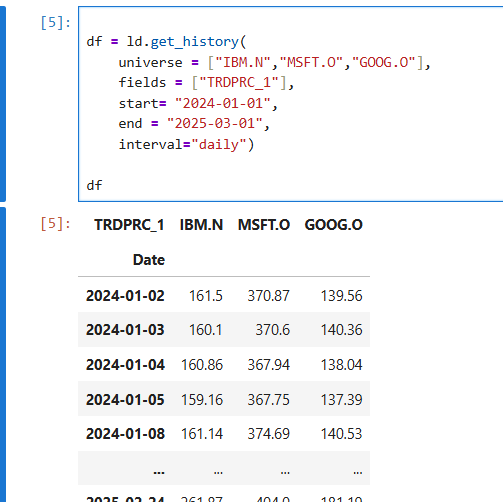

df = ld.get_history( universe = ["IBM.N","MSFT.O","GOOG.O"], start= "2024-01-01", end = "2025-03-01", interval="daily") dfIf you don't specify the fields parameter, it will return all available fields. Otherwise, you can specify the required fields in fields parameter, such as TRDPRC_1.

df = ld.get_history( universe = ["IBM.N","MSFT.O","GOOG.O"], fields = ["TRDPRC_1"], start= "2024-01-01", end = "2025-03-01", interval="daily") dfYou can change the start, end, and interval parameters and use the help command to list all parameters.

help(ld.get_history)

The examples are also available on GitHub.

0 -

Thanks for the response @jirapongse. How do I make sure these closing prices are in USD?

0 -

I forgot about the currency. In this case, you can use the TR.ClosePrice field.

df = ld.get_history( universe = ["IBM.N","MSFT.O","GOOG.O","PTT.BK"], fields = ["TR.ClosePrice(Curn=USD)"], start= "2024-01-01", end = "2025-03-01", interval="daily") df0 -

Thanks again @Jirapongse .

We are not there yet.

The following 2 are the excel formulas that I am using so far and want to now use APIs to get these data points.

———————————-——

1) DSGRID(MASTER_LIST!$A3:$B3000,"1000*X(RI)~U$/MSACWF$(RI)","2022-01-01","","D","CustomHeader=true;CustHeaderDatatypes=RIC;RowHeader=true;ColHeader=true;DispSeriesDescription=false;YearlyTSFormat=false;QuarterlyTSFormat=false;Sym=RIC;MonthlyTSFormat=True","")

2) @DSGRID(MASTER_LIST!$A3:$B3000,"X(RI)~U$","2022-01-01","","D","CustomHeader=true;CustHeaderDatatypes=RIC;RowHeader=true;ColHeader=true;DispSeriesDescription=false;YearlyTSFormat=false;QuarterlyTSFormat=false;Sym=RIC;MonthlyTSFormat=False","")

———————————-——With respect to the above two

a) 1000*X(RI)~U$/MSACWF$(RI) : Here I believe we are trying to get a relative price of the constituents (in master_list a3-b3000) against an index.b) X(RI)~U$ : Here the absolute prices for the same instruments.

This is exactly what I am looking for.

My thought wasdf = ld.get_history( universe = ["IBM.N","MSFT.O","GOOG.O","PTT.BK"], fields = ["TR.ClosePrice(Curn=USD)"], start= "2024-01-01", end = "2025-03-01", interval="daily")df

For example will yield the answer atleast for the point I mentioned above in 2nd, but It wasnt really matching up.

Can we try to convert 1) and 2) i.e. mentioned excel formulas into python code?0 -

DSGRID is a Datastream product. You can use the Datastream Web Service to retrieve data.

The DatastreamPy Python library is available on Pypi.

The code looks like this:

df = ds.get_data(tickers="@GOOGL,U:IBM", fields = [ "1000*X(RI)~U$/MSACWF$(RI)", "X(RI)~U$"], kind=1, freq='D', start="2022-01-01") df0 -

I imagine that pricing data that you shared works on the mnemonics as the inputs, Correct? I remember in eikon there was a direct way to convert them from one symbol type to another, couldnt really find a way to convert RICs to Mnemonics in LSEG.data. Any workaround for that?

I also tried to work with :

response = symbol_conversion.Definition(

symbols=["MSFT.O", "AAPL.O", "GOOG.O", "IBM.N"]

).get_data()response.data.df

This doesnt rwally give mnemonics.

2) For an entirely different problem,

I am interested in getting the following data :

(RIC', 'NAME', 'SECD', 'WTIDX', 'ISOCUR', 'MSCNSN', 'MSCNIGN', 'MSCNIN', 'MSCNSIN', 'MSCTRYN', 'WC06028'

)

I am able to get it on the list level as dictated by "LMSACWF0424", I want to replicate the same on stock (RIC) level

df=ds.get_data(tickers='LMSACWF0424', fields=('RIC', 'NAME', 'SECD', 'WTIDX', 'ISOCUR', 'MSCNSN', 'MSCNIGN', 'MSCNIN', 'MSCNSIN', 'MSCTRYN', 'WC06028'), kind=0)

Please suggest the best ways to do that.0 -

It also works with RICs by enclosing a RIC with the <…>. For example:

df = ds.get_data(tickers="<MSFT.O>,<AAPL.O>,<GOOG.O>,<IBM.N>", fields = [ "1000*X(RI)~U$/MSACWF$(RI)", "X(RI)~U$"], kind=1, freq='D', start="2022-01-01") df0

Categories

- All Categories

- 3 Polls

- 6 AHS

- 37 Alpha

- 167 App Studio

- 6 Block Chain

- 4 Bot Platform

- 18 Connected Risk APIs

- 47 Data Fusion

- 34 Data Model Discovery

- 705 Datastream

- 1.5K DSS

- 633 Eikon COM

- 5.2K Eikon Data APIs

- 14 Electronic Trading

- 1 Generic FIX

- 7 Local Bank Node API

- 6 Trading API

- 3K Elektron

- 1.5K EMA

- 259 ETA

- 569 WebSocket API

- 40 FX Venues

- 16 FX Market Data

- 1 FX Post Trade

- 1 FX Trading - Matching

- 12 FX Trading – RFQ Maker

- 5 Intelligent Tagging

- 2 Legal One

- 25 Messenger Bot

- 4 Messenger Side by Side

- 9 ONESOURCE

- 7 Indirect Tax

- 60 Open Calais

- 284 Open PermID

- 47 Entity Search

- 2 Org ID

- 1 PAM

- PAM - Logging

- 6 Product Insight

- Project Tracking

- ProView

- ProView Internal

- 24 RDMS

- 2.2K Refinitiv Data Platform

- 879 Refinitiv Data Platform Libraries

- 5 LSEG Due Diligence

- 1 LSEG Due Diligence Portal API

- 4 Refinitiv Due Dilligence Centre

- Rose's Space

- 1.2K Screening

- 18 Qual-ID API

- 13 Screening Deployed

- 23 Screening Online

- 12 World-Check Customer Risk Screener

- 1K World-Check One

- 46 World-Check One Zero Footprint

- 45 Side by Side Integration API

- 2 Test Space

- 3 Thomson One Smart

- 10 TR Knowledge Graph

- 151 Transactions

- 143 REDI API

- 1.8K TREP APIs

- 4 CAT

- 27 DACS Station

- 123 Open DACS

- 1.1K RFA

- 108 UPA

- 196 TREP Infrastructure

- 232 TRKD

- 919 TRTH

- 5 Velocity Analytics

- 9 Wealth Management Web Services

- 103 Workspace SDK

- 11 Element Framework

- 5 Grid

- 19 World-Check Data File

- 1 Yield Book Analytics

- 48 中文论坛