GDAX options not returning TRDPRC_1 via API

I am downloading data for multiple security types (options, equities and indices) and below code provides me with the data I need except for (DAX) Index options at EUREX, e.g. GDAX236000U5.EX.

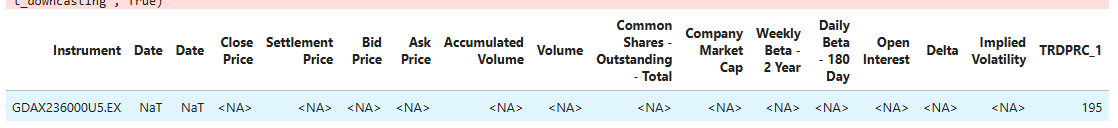

So, most of the fields below will be empty for an option but I would expect at least "TRDPRC_1" to be populated as this can be retrieved via excel.

stock2 = rd.get_data(

universe=[i for i in updated_rics if i is not None],

fields= [ 'TR.CLOSEPRICE.date', 'TR.BIDPRICE.date','TR.CLOSEPRICE','TRDPRC_1','TR.SETTLEMENTPRICE','TR.BIDPRICE','TR.ASKPRICE', 'TR.ACCUMULATEDVOLUME', 'TR.VOLUME', 'TR.F.ComShrOutsTot','TR.COMPANYMARKETCAP', 'TR.BetaWkly2y','TR.BetaDaily180D','TR.OPENINTEREST','TR.DELTA','TR.IMPLIEDVOLATILITY'],

parameters= {'SDate': positionsdate.strftime('%Y-%m-%d'), 'EDate': valuation_date.strftime('%Y-%m-%d'), 'FRQ': 'D'})

Can someone help with this?

Answers

-

Thank you for reaching out to us.

I ran this code and could get only the TRDPRC_1 field.

ld.get_data( universe = ['GDAX236000U5.EX'], fields = [ 'TR.CLOSEPRICE.date', 'TR.BIDPRICE.date', 'TR.CLOSEPRICE', 'TRDPRC_1', 'TR.SETTLEMENTPRICE', 'TR.BIDPRICE', 'TR.ASKPRICE', 'TR.ACCUMULATEDVOLUME', 'TR.VOLUME', 'TR.F.ComShrOutsTot', 'TR.COMPANYMARKETCAP', 'TR.BetaWkly2y', 'TR.BetaDaily180D', 'TR.OPENINTEREST', 'TR.DELTA', 'TR.IMPLIEDVOLATILITY'] )Can you share the Excel formula used to retrieve the data? You can use the Data Item Browser tool or Formula Builder in Excel to search for fields and parameters.

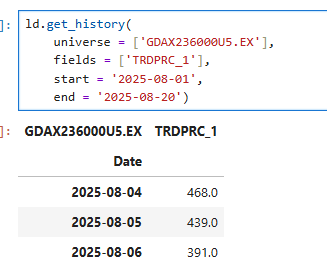

To get the historical data of the TRDPRC_1 field, you can use the get_history method. For example:

ld.get_history( universe = ['GDAX236000U5.EX'], fields = ['TRDPRC_1'], start = '2025-08-01', end = '2025-08-20')0 -

HI @Jirapongse

Thank you very much for your answer.

Somehow I am unable to replicate your result using get_data. When using get_history I am seeing the same.

Looking at the parameters I am requesting, what would you suggest is the easiest and cleanest way to get all that data for multiple security types? Being honest I am getting more confused by the day working with refinitiv api as I just do not understand what is available using what function and why there are e.g. different field namings for BID prices across security types.

Thank you

Fabian

0 -

To verify what the problem, you need to enable the debug log by running the following code before opening a session.

config = ld.get_config()

config.set_param("logs.transports.file.enabled", True)

config.set_param("logs.transports.file.name", "lseg-data-lib.log")

config.set_param("logs.level", "debug") ld.open_session()With this code, the lseg-data-lig.log file will be created.

Please remove any private information from the file and then share it.

This forum is dedicated to software developers using LSEG APIs. The moderators on this forum do not have deep expertise in every bit of content available through LSEG products, which is required to answer content questions such as this one.

The best resource for content questions is the Helpdesk support team, which can be reached by submitting queries through LSEG Support. The support team will either have the required content expertise ready available or can reach out to relevant content experts to get the answer for you.You need to ask for the Excel formula, such as =RDP.Data, that can be used to retrieve the required data.

Then, we can help you converting that formula to Python code.

Please include the URL of this discussion in your raised question to prevent it from being redirected back to this Q&A forum.

0

Categories

- All Categories

- 3 Polls

- 6 AHS

- 37 Alpha

- 167 App Studio

- 6 Block Chain

- 4 Bot Platform

- 18 Connected Risk APIs

- 47 Data Fusion

- 34 Data Model Discovery

- 709 Datastream

- 1.5K DSS

- 633 Eikon COM

- 5.2K Eikon Data APIs

- 16 Electronic Trading

- 1 Generic FIX

- 7 Local Bank Node API

- 8 Trading API

- 3K Elektron

- 1.5K EMA

- 260 ETA

- 571 WebSocket API

- 41 FX Venues

- 16 FX Market Data

- 2 FX Post Trade

- 1 FX Trading - Matching

- 12 FX Trading – RFQ Maker

- 5 Intelligent Tagging

- 2 Legal One

- 26 Messenger Bot

- 4 Messenger Side by Side

- 9 ONESOURCE

- 7 Indirect Tax

- 60 Open Calais

- 285 Open PermID

- 48 Entity Search

- 2 Org ID

- 1 PAM

- PAM - Logging

- 6 Product Insight

- Project Tracking

- ProView

- ProView Internal

- 25 RDMS

- 2.3K Refinitiv Data Platform

- 17 CFS Bulk File/TM3

- 909 Refinitiv Data Platform Libraries

- 5 LSEG Due Diligence

- 1 LSEG Due Diligence Portal API

- 4 Refinitiv Due Dilligence Centre

- Rose's Space

- 1.2K Screening

- 18 Qual-ID API

- 13 Screening Deployed

- 23 Screening Online

- 12 World-Check Customer Risk Screener

- 1K World-Check One

- 46 World-Check One Zero Footprint

- 45 Side by Side Integration API

- 2 Test Space

- 3 Thomson One Smart

- 10 TR Knowledge Graph

- 151 Transactions

- 143 REDI API

- 1.8K TREP APIs

- 4 CAT

- 27 DACS Station

- 126 Open DACS

- 1.1K RFA

- 108 UPA

- 197 TREP Infrastructure

- 232 TRKD

- 923 TRTH

- 5 Velocity Analytics

- 9 Wealth Management Web Services

- 106 Workspace SDK

- 11 Element Framework

- 5 Grid

- 19 World-Check Data File

- 1 Yield Book Analytics

- 48 中文论坛