When are Market Price Refresh messages sent?

I'm experimenting with consuming Market Price messages using the EMA. I have a simple prototype that logs in, subscribes to a RIC, then prints all the messages it receives to the console. When I run my program, after logging in, I see a single Refresh message and then a series of Update messages afterwards.

If I left my program running indefinitely, when should I expect to receive another Refresh message? For example, would I receive another Refresh at some point after the current trading day, to "reset" some of the fields to (blank data) before the next trading day?

Does this behaviour differ between RICs/exchanges/geographies etc?

I read section 6.2.2 of the domain model guide (https://developers.lseg.com/content/dam/devportal/realtimeapi_pdfs/emaj_rdm_usage_guide.pdf), but it doesn't seem to describe when that type of message will be sent.

By the way, whenever the guide mentions the "provider", I'm assuming it means Refinitiv/LSEG, so please let me know if I've got that wrong.

Thank you.

Answers

-

Hello @Nick_G

A Refresh message is used to synchronize all data fields between a consumer and the source of data, and as such it can be sent at any time. It is typically sent when the consumer first requests data for an instrument, and also if the infrastructure senses a disconnect or any other event. An application should be prepared to receive an unsolicited Refresh message at any time - without any fixed schedule.

Here is the recommended approach for a consumer application -

Received a Refresh or unsolicited Refresh = discard existing internal cache and re-populate all fields.

Received an Update message = replace the cached fields with new ones in the message.

1 -

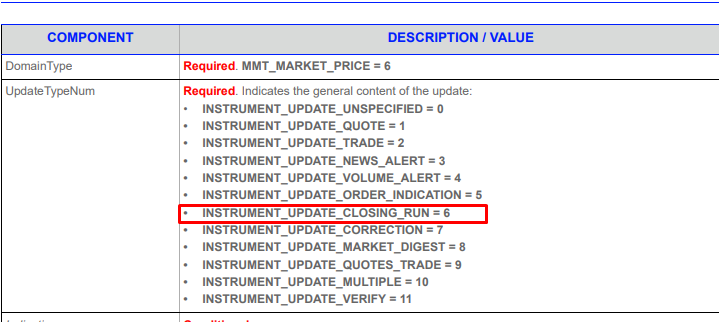

Typically, we use the Closing Run update type in the update message to reset fields.

Closing Run CorrectionA broadcast message to reset fields within a record before commencement of trading. Typically such adjustments are: previous night‘s last traded price is copied to the close price field. These messages are not a reflection of market activity. The information is sent using an update event.

0

Categories

- All Categories

- 3 Polls

- 6 AHS

- 37 Alpha

- 167 App Studio

- 6 Block Chain

- 4 Bot Platform

- 18 Connected Risk APIs

- 47 Data Fusion

- 34 Data Model Discovery

- 712 Datastream

- 1.5K DSS

- 638 Eikon COM

- 5.3K Eikon Data APIs

- 19 Electronic Trading

- 1 Generic FIX

- 7 Local Bank Node API

- 11 Trading API

- 3K Elektron

- 1.5K EMA

- 260 ETA

- 572 WebSocket API

- 42 FX Venues

- 16 FX Market Data

- 2 FX Post Trade

- 1 FX Trading - Matching

- 12 FX Trading – RFQ Maker

- 5 Intelligent Tagging

- 2 Legal One

- 26 Messenger Bot

- 5 Messenger Side by Side

- 9 ONESOURCE

- 7 Indirect Tax

- 60 Open Calais

- 285 Open PermID

- 47 Entity Search

- 2 Org ID

- 1 PAM

- PAM - Logging

- 6 Product Insight

- Project Tracking

- ProView

- ProView Internal

- 25 RDMS

- 2.3K Refinitiv Data Platform

- 19 CFS Bulk File/TM3

- 935 Refinitiv Data Platform Libraries

- 5 LSEG Due Diligence

- 1 LSEG Due Diligence Portal API

- 4 Refinitiv Due Dilligence Centre

- Rose's Space

- 1.2K Screening

- 18 Qual-ID API

- 12 World-Check Customer Risk Screener

- World-Check On Demand

- 1K World-Check One

- 46 World-Check One Zero Footprint

- 46 Side by Side Integration API

- 2 Test Space

- 3 Thomson One Smart

- 10 TR Knowledge Graph

- 151 Transactions

- 143 REDI API

- 1.8K TREP APIs

- 4 CAT

- 27 DACS Station

- 126 Open DACS

- 1.1K RFA

- 108 UPA

- 197 TREP Infrastructure

- 232 TRKD

- 925 TRTH

- 5 Velocity Analytics

- 9 Wealth Management Web Services

- 106 Workspace SDK

- 11 Element Framework

- 5 Grid

- 19 World-Check Data File

- 1 Yield Book Analytics

- 48 中文论坛